Having a six-month emergency fund isn’t an indication of wealth. Living expenditures are the primary source of money creation. To invest, you must retain your existing standard of life. If you work hard enough, you may produce a life-altering resource.

Making money has ripple effects on the economy, employment, and lives of individuals. These are the five pillars of wealth production that we must comprehend if we discuss wealth creation. Making money from your ideas and information, the second pillar of wealth creation can help you get started.

We are lured to material items as we accumulate them. Wealth is built using money, investments, and other things. We create and share value by storing rather than collecting resources. To increase your net worth, you should invest in the stock market. As the saying goes, hard work pays off in this pillar.

Some feel that material things might help one’s financial situation. Owning a company is a great way to generate money and accumulate wealth. A person’s wealth is built on money, real estate, and business.

Value creation and delivery may lead to long-term financial success. Others labor to save for retirement, enhance their “families'” life, preserve their children’s education, or start a company. Building wealth may help you attain both goals. “Making money” may mean numerous things to different individuals. Some people invest part-time in real estate, equities, bonds, and other financial instruments, while others work full-time and increase their financial assets.

Regardless of your feelings, you must make money for others to be wealthy. Only a few individuals have achieved global fame due to their money and power. Putting together a network of people isn’t enough.

So everyone creates new firms, constructs new buildings, and develops new technology. Nobody makes money building or developing ideas, even if you bring back an engineer. The world’s wealthiest persons built their fortunes via business success.

It’s as though the rich are already wealthy regarding money. Wealthy folks have recently discovered the powerful’s money-making homeostasis. Their strategy of linking the rich with the poor has worked well. Employment, training, care, and cleaning services all rely on the labor of others to produce money.

Prudent borrowing is one of the four pillars of wealth building. Because real estate is so valuable, you may need a loan to purchase a fortune. However, wealth provides a third option to grow rich without paying off debt. Monthly cash flows, real estate assets, and loan repayments form a formidable home investment trifecta.

The value of your property may improve or decrease, but if it increases, it will assist you financially. You’ll never lose money with the Universal Life EIUF Equity Index, and you may access the current loan amount. However, you should invest your money immediately rather than saving it in SACCO Savings or Smart Tomorrow.

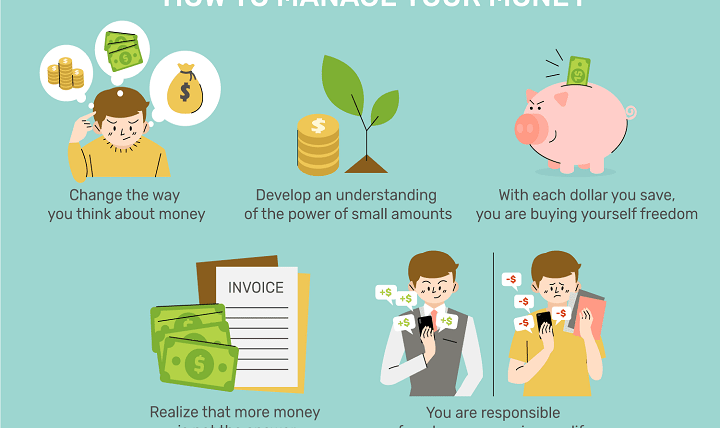

How to Manage Your Money and Increase Your Net Worth in a Realistic Way Our wealth-building strategy is based on five key ideas. Building a solid financial foundation that can weather life’s storms is essential for financial success.

To build and maintain your economic empire, you must spend and invest in the wealth pillars. The BiggerPocket team’s four wealth-building pillars are ones I strongly embrace. I added a fifth to create money, which accomplishes nothing but is vital.

The Holy Quran advises against putting your money in the hands of foreign lenders or enterprises. Financial success requires possessions. Getting rich requires working in the real world.

If you can follow all these tips, you will be easily able to build vast wealth within a short time. So, try them out and follow everything professionally to succeed following those things.