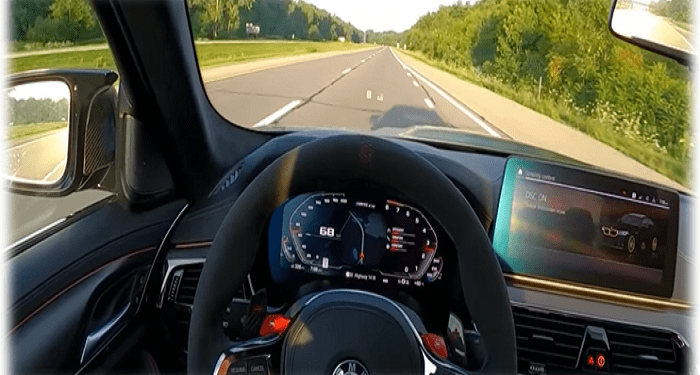

Anyone with a driving license of less than one year is considered a new driver, regardless of age. This also determines the price of insurance that you will be charged. Age, on the other hand, is another concept that will increase the premium because if, in addition to being a beginner, you are under 25 years of age, it will be higher.

Usually, when people get their driving license, they want to have a car with which to put into practice the knowledge acquired and validated on their license. As in any other case, however, it is necessary to have insurance to circulate correctly. For this, the most recommended thing is a quote comparator to find the best assistance and prices.

From our experience, novice drivers are usually very interested in knowing if the car they drive is insured and if it has a valid policy, and with which insurer, either because it is a borrowed car or because it has not been years used.

Rookie Driver

Car insurance for a rookie driver will have to have certain aspects before hiring it, such as the coverage it offers and what price the insurers pay you, taking that aspect into account, especially if you want to get cheap car insurance, usually something relevant for most young people. It is generally worth twice as much for a novice driver.

Generally, since it is often said, for this type of driver, the prices of this type of product increase, however, using online tools like the one provided by the Direct Auto Insurance website, you would find all the alternatives so that in the shortest possible time, you would have the best possibilities with the most adjusted affordable prices.

Ways to save on car insurance as a new driver

If a novice driver thinks of ways to save, it’s best to tailor coverage to what he really needs. This represents the difference between third-party insurance and comprehensive insurance, for example.

- Include the new driver as a regular driver: This is the most widespread and recommended option; With this, the driver is more protected and with more excellent coverage, and in case of any accident, he will not appear responsible, but the policy will increase when the insurer knows that the driver is someone new. Here you will also carry several bonuses for the new driver.

- Include the driver as occasional: In this case, mainly when a child uses the parent’s car, the owner remains the same, but the use becomes shared. The insurance premium does not go up as much as in the previous scenario, but some insurers may consider it fraudulent if the “occasional” driver is the main one.

- Do not include the new driver: It is clear that the novice driver uses the vehicle, but it does not appear on the policy due to its increase in premium. The risk is evident since he is left unprotected.

In any case, consider that third-party insurance for new drivers has a somewhat variable price range, given the reluctance that some insurers have for these drivers.

New Driver Limitations

As we have mentioned before, the best way for you to know the price you are going to pay for your insurance and what coverage you are going to be able to enjoy during your first days on the road is with a car insurance comparator. We can guarantee that you will find no money down car insurance for new drivers through Young America Insurance. Just start comparing insurance quotes and determine the best option for your individual needs.